Table of Contents

Introduction: AI Advantage

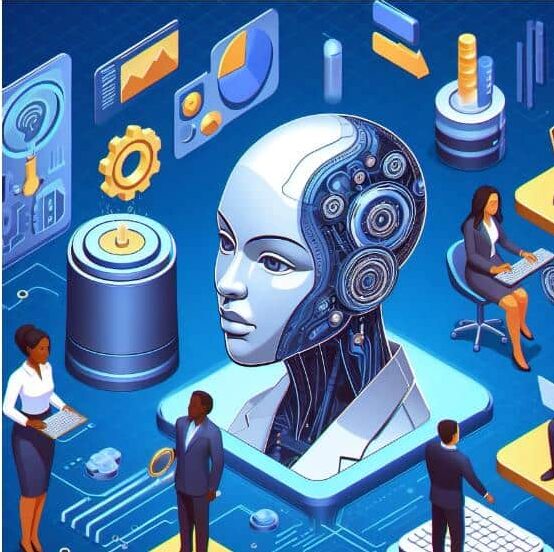

The AI Advantage is a game-changer in today’s dynamic business landscape, particularly for finance and accounting teams. These teams are tasked with managing costs, optimizing cash flow, and delivering strategic growth insights amidst complexity. By 2024, AI and automation technologies are projected to significantly disrupt business operations, underscoring the importance of leveraging this advantage.

The Impact of AI on Business

Forget the dot-com boom, forget the rise of mobile – the next big wave, the one that’s going to reshape our world more than anything we’ve seen before, is here: it’s the AI Advantage. According to top CEOs around the globe, artificial intelligence isn’t just a fancy tech upgrade, it’s a paradigm shift with the potential to add a mind-blowing $15.7 trillion to the global GDP by 2030. That’s more than the combined economic output of China and India – the two most populous countries on Earth!

This isn’t just hype; it’s the reality of the AI Advantage unfolding before our eyes. Industries are being revolutionized, from healthcare to finance to manufacturing, as AI-powered solutions unlock unprecedented efficiency, innovation, and growth. The question isn’t whether AI will change the world, but how fast we can adapt and ride this wave of progress. Are you ready to seize the AI Advantage?

The Evolving Role of the CFO

The AI Advantage is not just a concept; it’s a transformative force reshaping the functioning of corporate roles, particularly that of the Chief Financial Officer (CFO). With AI and automation technologies now becoming a common business fixture, the traditional role of the CFO is undergoing a significant evolution.

Gone are the days when CFOs were expected to deliver insights only at the end of the fiscal month. Today, they are required to provide actionable intelligence in real-time. This transition necessitates a shift from retrospective reporting to forward-thinking analysis and strategic decision-making. The key to achieving this lies in the heart of the AI Advantage.

By embracing automation software, finance and accounting teams can effectively delegate repetitive tasks to AI. This not only increases efficiency but also liberates time for CFOs to focus on strategic initiatives and advanced analytics, reinforcing their role as pivotal decision-makers in the organization. In this era of rapid technological advancements, the AI Advantage is no longer a luxury but a prerequisite for CFOs aiming to stay relevant and drive their organizations towards success.

Investing in AI: Key Considerations for CFOs

The AI Advantage: A Strategic Guide for CFOs Investing in AI

As CFOs navigate the rapidly evolving landscape of AI, there are several key considerations to keep in mind to fully harness the AI Advantage:

- Invest in Financial Transformation: The journey towards AI integration should be seen as a continuous investment rather than a one-time cost. Intelligent automation and best-in-class point solutions can work in tandem with your existing ERP system to create a robust, adaptable technology ecosystem. This composable architecture allows for flexibility and scalability, ensuring your financial systems can evolve with the changing business landscape.

- Foster Organizational Partnerships: The power of AI extends beyond the finance department. By delivering complete, timely, and accurate financial reporting, CFOs can provide actionable insights that drive strategic decisions across the entire organization. This collaborative approach not only enhances decision-making but also fosters a culture of data-driven insights throughout the enterprise.

- Strategically Reduce Costs: While AI requires an initial investment, it can also be a powerful tool for cost reduction. By automating high-volume, repetitive tasks, AI can free up resources for growth initiatives and broader enterprise support. This allows CFOs to strategically cut outdated or redundant expenditures, optimizing the organization’s financial health.

- Develop a Comprehensive AI Strategy: To truly harness the AI Advantage, it’s crucial to have a well-defined plan. This should outline how AI will be integrated into key financial processes such as the financial close, planning, forecasting, reporting and analytics. By having a clear roadmap, CFOs can ensure a smooth transition towards AI-powered finance operations.

Remember, the AI Advantage isn’t just about adopting new technology—it’s about transforming the way your organization operates. By keeping these considerations in mind, CFOs can lead their organizations towards a future where AI is a powerful ally in driving growth, efficiency, and strategic decision-making.

Elevating Financial Processes with AI

Once a solid foundation has been laid, finance and accounting teams can leverage AI and automation to further productivity gains. The key value drivers gained from AI include:

- Improved collaboration between teams and departments

- Productivity gains

- Deeper engagement

- Improved user proficiency

- Less costly infrastructure

For accountants, the greatest benefits of AI are time savings and reduced tedious work, especially in the financial close process. By automating repetitive, rules-based functions like account reconciliations and transaction matching, AI becomes a “coworker” that assists in getting the job done more effectively. This allows accountants to focus on value-adding tasks and become strategic business partners.

Preparing for the Challenges Associated with AI

While AI and ML offer immense potential, they also come with unique challenges:

- Data quality and quantity: ML and AI require vast amounts of high-quality training data to learn effectively.

- Ongoing reconfiguration: A consistent feedback loop, guided by well-defined enterprise rules, is essential to prevent AI from becoming degraded or outdated.

- High development costs: The resources needed to train and maintain AI can lead to significant expenses.

- Ethical concerns: Data security, regulations, and potential bias in AI outputs must be addressed through clear policies and regular reviews.

To overcome these challenges, organizations must invest in core capabilities like human talent, data governance, and initiatives that create a stable foundation for AI technologies.

Applying AI to Financial Close Processes

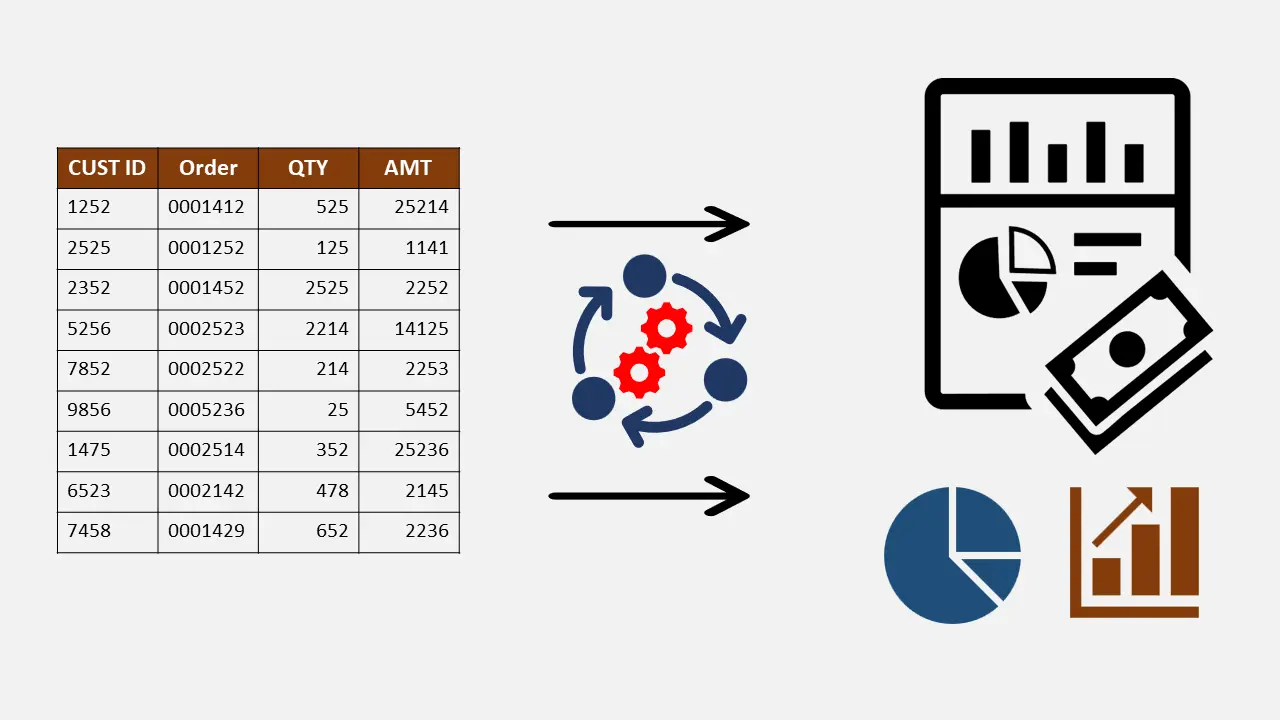

The financial close process is highly rules-based, creating several opportunities for AI applications to aid accounting teams:

- General ledger reconciliations: Retrieve bank statements, reconcile to the ERP, and create entries for exceptions.

- Financial reporting: Automate data extraction and aggregation, and identify exceptions for review.

- Journal entry processing: Check for complete and accurate information, prepare the JE automatically, and post it to the ERP.

- Management reporting: Retrieve ledgers, enrich them with other sources, and prepare initial variance reports for analysis.

- Intercompany accounting: Check and reconcile counterparty balances, and create exception reports.

The Future of Finance with AI

As AI and automation become more prevalent, the roles and responsibilities of finance and accounting teams will shift from historical reporting to forward-thinking analysis and strategy. Accountants will need to develop new skills, such as:

Understanding ML techniques to train, test, and audit models and algorithms

Applying context to the business surrounding the data

Collaborating with experts and other parts of the business

Explaining, verifying, and securing AI processes

By embracing AI and ML, accountants will be empowered to provide timely and relevant data to make better business decisions, grow revenue, improve efficiencies, and better manage risk and compliance.

One of the tools I have mastered for financial reporting is Power Query. It can help automate routine reporting. Check out this article to learn more about it.

Current available AI Solutions and Future Developments

Many leading providers of financial close automation solutions have been at the forefront of leveraging AI and ML technologies to streamline processes and drive efficiency. Their solutions feature:

- ML algorithms for suggesting transaction matches

- Transaction risk rating engine using ML

- RPA capabilities for journal entry processes and ERP integration

Looking ahead, these solutions are committed to pioneering AI and automation in the financial close through their Innovation Lab and Center of Excellence. They are developing solutions for:

- Automated customer engagement and support

- Autogenerated configurations for streamlined implementation

- Predictive analytics and ML algorithms for transaction matching and journal entry creation

- Proactive exception handling with intelligent pattern recognition

- Natural language interaction for data querying

FAQs or Frequently Asked Questions

According to PwC’s 22nd Annual Global CEO Survey, AI has the potential to add $15.7 trillion to global GDP by 2030, more than the current output of China and India combined.

CFOs and finance teams should invest in financial transformation, partner with the rest of the organization, focus on strategic cost reduction, and create a company plan to harness the potential of AI.

The key value drivers include improved collaboration, productivity gains, deeper engagement, improved user proficiency, and less costly infrastructure.

The main types of AI solutions are Robotic Process Automation (RPA), Large Language Models (LLM), and Generative AI (GenAI).

Challenges include data quality and quantity, ongoing reconfiguration, high development costs, and ethical concerns such as data security, regulations, and potential bias.

Challenges include data quality and quantity, ongoing reconfiguration, high development costs, and ethical concerns such as data security, regulations, and potential bias.

Finance and accounting teams can become agents of change by embracing AI and automation as co-workers, redesigning human roles and responsibilities, creating a new work culture with a future-focused ethos, and rewriting the narrative to become a profit center and value to the business.

Conclusion

As we look towards 2024 and beyond, the integration of AI and automation in the financial close process will be a game-changer for finance and accounting teams. By harnessing the power of these technologies, organizations can drive efficiencies, ensure accuracy, mitigate risk, and empower strategic decision-making. CFOs and their teams must embrace this transformation, developing new skills and adapting to evolving roles to become true finance heroes and agents of change.