Learn how to create a reliable cash flow forecast using Excel or Google Sheets for your startup. This comprehensive guide covers everything you need about cash flow forecasting, from gathering data to analyzing and adjusting your forecast.

Table of Contents

Introduction

Cash flow management is one of the essential aspects of any business, including startups.

Understanding your company’s current and future cash flow can help you make informed decisions that can steer your business towards success. A cash flow forecast is an excellent tool for tracking and managing cash flow.

This article will provide you with a comprehensive guide on creating a cash flow forecast using Excel or Google Sheets for your startup.

What is a Cash Flow Forecast?

A cash flow forecast is a financial statement that tracks the movement of cash in and out of business over a specific period.

A cash flow forecast enables business owners to understand how much cash they have on hand, where it is coming from, and where it is going. It is essential for planning, budgeting, and monitoring cash flow.

Read more about the Cash flow forecast here.

Why is a Cash Flow Forecast important for Startups?

Cash flow management is crucial for startups because they often have limited resources and are highly dependent on cash flow to fund operations, grow their business, and stay afloat. A cash flow forecast helps startups to:

- Plan and budget for future cash needs

- Identify potential cash flow gaps and take corrective action before they become critical

- Prioritize spending and allocate resources more effectively

- Secure financing and investments by demonstrating their ability to manage cash flow

- Stay on top of cash flow and make timely decisions to avoid financial difficulties or bankruptcy

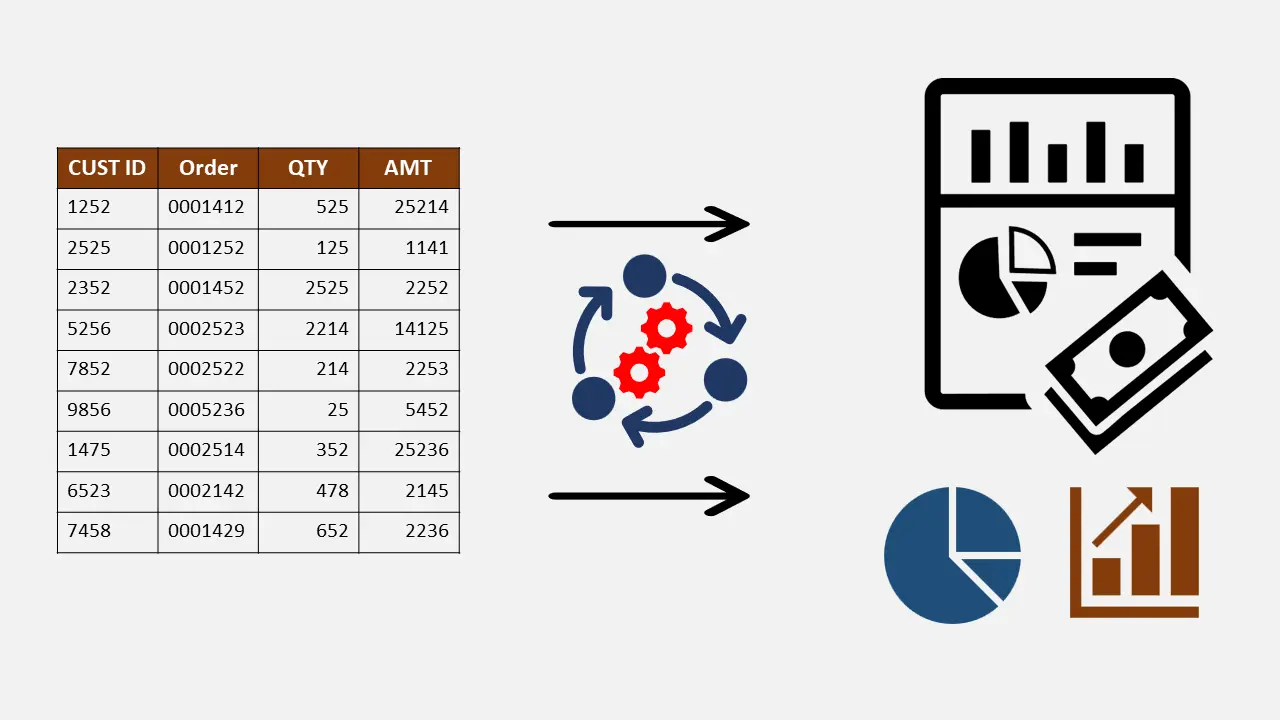

How to create a Cash Flow Forecast in Excel or Google Sheets?

Creating a cash flow forecast using Excel or Google Sheets is easy. You can start by following these steps:

Step 1: Gather Your Data

Before creating a cash flow forecast, you must gather data on your business’s past and current cash flow. This data includes:

- Sales and Revenue

- Expenses (both fixed and variable)

- Accounts payable and receivable

- Investments and loans

- Cash reserves

Step 2: Create a Cash Flow Statement

The next step is to create a cash flow statement that shows the net cash flow for each period (usually monthly or quarterly) over the forecast period. A cash flow statement has three main sections:

- Cash inflows: This includes all sources of cash, such as sales, loans, and investments.

- Cash outflows: This includes all cash payments, such as expenses, salaries, and taxes.

- Net cash flow is the difference between cash inflows and outflows.

Step 3: Forecast Your Cash Flow

Once you have your cash flow statement, you can start forecasting your cash flow for the future. To do this, you must make assumptions about your future sales, expenses, cash inflows, and outflows based on past trends, market conditions, and other factors that may affect your business. You can use Excel or Google Sheets to create a formula that automatically calculates your future cash flow based on your assumptions.

Step 4: Analyze and Adjust

After creating your cash flow forecast, it is essential to analyze it to identify potential issues and take corrective action. You can compare your forecasted cash flow to actual cash flow to identify gaps and adjust your assumptions accordingly.

Tips for Creating a Reliable Cash Flow Forecast

To create a reliable cash flow forecast, consider the following tips:

- Use realistic assumptions based on your past performance and market conditions

- Monitor your actual cash flow regularly and adjust your forecast accordingly

- Be conservative when estimating your cash inflows and optimistic when estimating your cash outflows

- Account for any seasonality or cyclical trends in your business

- Consider various scenarios, such as best-case and worst-case, to prepare for unexpected events

Where to get a ready-made Financial Model for Cash flow forecast?

I have created a fully functional financial model to forecast:

- Income statement or Profit or loss statement

- Forecast Revenues based on many criteria: Fixed or dynamically

- Cash collections from your customer – How much credit you should give your customers without significantly raising your risk.

- Cash payments to your suppliers – Suppliers are as important as customers. We’ll show you how you should negotiate with your suppliers to give you optimum credit to ensure the overall cash position of your business is always positive.

- If you run out of cash for any reason, you can set up a revolving line of credit with your bank to provide you with a temporary line of credit or bank overdraft. This model lets you forecast that, so you can view how much quick funding will be required if the business is not performing well while maintaining operations at a base level.

- If you are borrowing temporarily, you must consider the cost of interest. This model lets you forecast interest expenditures and shows you how to manage your credit effectively.

Conclusion

Creating a cash flow forecast using Excel or Google Sheets is a vital tool for startups to manage their finances effectively. By forecasting your cash flow, you can plan and budget for future cash needs, identify potential gaps, prioritize spending, secure financing and investments, and avoid financial difficulties or bankruptcy.

To create a reliable cash flow forecast, it is crucial to gather accurate and up-to-date data on your business’s past and current cash flow. You should also make realistic assumptions about your future cash inflows and outflows based on market conditions, past trends, and other factors that may affect your business.

Excel and Google Sheets provide powerful tools for creating and analyzing cash flow forecasts. You can use formulas and functions to automate your calculations, create charts and graphs to visualize your data, and perform what-if analysis to explore different scenarios.

In conclusion, managing your startup’s cash flow is essential to its success. By creating a cash flow forecast using Excel or Google Sheets, you can gain insight into your business’s financial health and make informed decisions that can help you grow and thrive.

Frequenty Asked Questions (FAQs)

A cash flow forecast is a financial statement that tracks the movement of cash in and out of a business over a specific period. It is essential for startups because it helps them plan and budget for future cash needs, identify potential cash flow gaps, prioritize spending, secure financing and investments, and avoid financial difficulties or bankruptcy.

To create a cash flow forecast using Excel or Google Sheets, you need to gather data on your business’s past and current cash flow, create a cash flow statement, forecast your cash flow for the future, and analyze and adjust your forecast as needed.

To create a reliable cash flow forecast, you should use realistic assumptions based on your past performance and market conditions, monitor your actual cash flow regularly, be conservative when estimating your cash inflows and optimistic when estimating your cash outflows, account for seasonality or cyclical trends, and consider various scenarios to prepare for unexpected events.

Cash flow forecasting can be used for both short-term and long-term planning. Short-term cash flow forecasts typically cover a period of a few months, while long-term cash flow forecasts can cover several years.

You should update your cash flow forecast regularly, ideally on a monthly basis. This will help you stay on top of your cash flow and make timely decisions to avoid financial difficulties.